Celebrating over €10 billion in CEB’s Social Inclusion Bonds: what a difference they can make

Blog by Felix Grote, Head of Long-term Funding

Since its inaugural Social Inclusion Bond (SIB) issuance in 2017, the Council of Europe Development Bank (CEB) reached the €10 billion milestone this year. This is an important achievement for the Bank, as it showcases not only our early commitment to the development of a social bond market, but also the keen interest from the investor community in our trademark financial product. In this blog, I would like to bring you along a pioneering journey that started almost a decade ago.

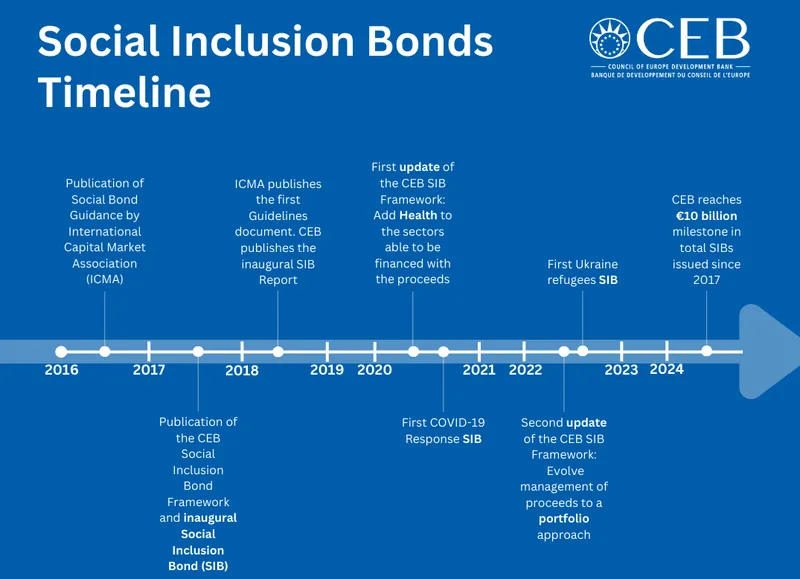

Figure 1: a pioneering journey

SIBs are a type of social bond whose proceeds are used by the CEB to finance social investments. This financial instrument embodies the Bank’s mandate and its expertise gained throughout almost seven decades in financing social investment projects that serve vulnerable people.

In 2017, when the first SIB was issued, this was a ground-breaking transaction as the social bond market was in its infancy. The CEB, one of the founders of the International Capital Markets Association (ICMA) Social Bond Working Group, worked closely with ICMA to develop a social bond market, including defining appropriate guidelines for this new instrument.

Having to choose the type of projects that the SIBs would finance, the CEB identified three strategically important investment sectors: education, social housing, and micro, small & medium enterprises (MSME) lending, with health sector added in 2020. But this innovative financing instrument has proved extremely versatile over the years, enabling the Bank to respond swiftly to the recent social crises – in particular COVID-19 pandemic and the war in Ukraine - effectively addressing the urgent social investment needs of our 43 member countries.

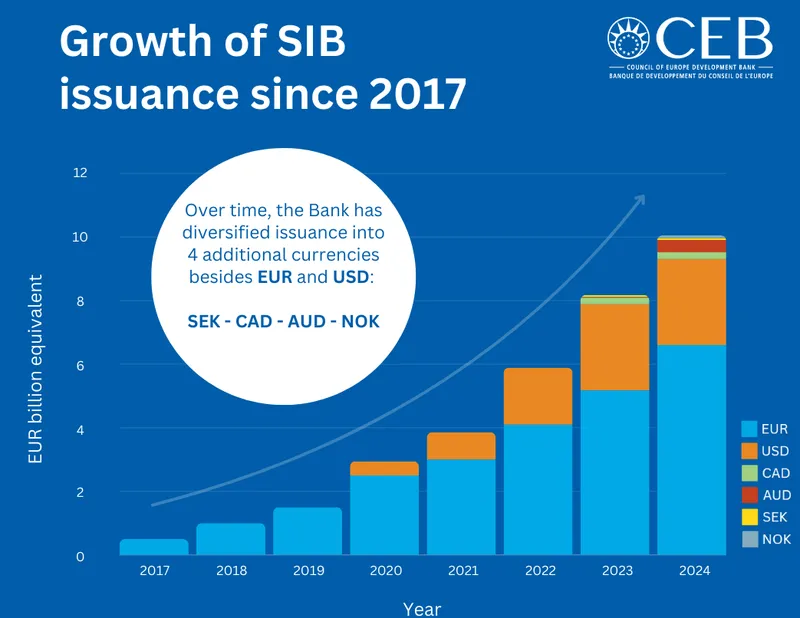

From a single transaction in 2017, the CEB has steadily ramped up SIB issuance volumes (Figure 2), with these bonds today making up more than 40% of the Bank’s annual funding programme. Besides, thanks to the dynamic and well-diversified nature of the Bank’s social lending, we decided to offer a broader range of SIB products such as increases on outstanding lines and issuances across different currencies beyond Euros and US dollars, such as Australian dollars, Canadian dollars, Norwegian krone and Swedish krona. With this strategy, the CEB has aimed to strengthen the overall Social Bond market and provide a wider and viable ESG investment options to investors.

Figure 2: Social Inclusion Bond issuance aggregate volume reached close to €11 billion equivalent in June 2024 denominated in six currencies

In April of this year, we hit another significant milestone - the issuance of our largest syndicated SIB to date, valued at €1.25 billion over a 7-year term.

The CEB has made a substantial impact in the Social Bond market and remains dedicated to fostering further innovation in sustainable finance. The tremendous work has also been recognised by the market through a number of awards, most notably the “2023 Best ESG Issuer” by CMDportal and “Social bond of the year - supranational” by Environmental Finance.

This would not have been possible without the support of the investor community. The Luxembourg Stock Exchange (LuxSE), in particular, along with the Luxembourg Green Exchange (LGX), has been a dedicated and loyal partner, supporting the CEB’s social inclusion bonds and sharing a common vision to grow the sustainable bond market.

Of course, the journey is far from over. As we look ahead we see both interesting prospects and challenges in the future. While our primary focus remains financing our member countries’ most pressing social needs, we are also keenly aware of the environmental dimensions of our work. The recent crises have disproportionately affected the most vulnerable populations, underscoring the need for a comprehensive approach to the unfinished social agenda. In response, the CEB is committed to aligning all its lending with the Paris Agreement, ensuring that all projects are Paris-aligned starting in 2024.

We are well aware of the social risks associated with the transition to a green economy. As this transition progresses, it is likely to create new vulnerable groups who will require the Bank’s support. The concept of a Just Transition is gaining momentum, and we are committed to helping member states implement it in practice.

With this in mind, it is not hard to imagine that the whole Social and Green Bond market will have to mirror each other more closely. It will be increasingly difficult to tell either story independently. In light of this, the CEB is paying close attention to disclosing more information on its environmental assessments and further improving its reporting practises going forward.

As I wrap this blog, I would like to invite you to read our latest yearly SIB Report. The work we do becomes much more meaningful when we consider its impact. Since 2017, thanks to our SIBs, we have financed education projects where almost 3.7 million students have had access to better facilities and thanks to MSME lending roughly 1.4 million people have been able to maintain their jobs. Almost 365 000 people are living in the social housing dwellings financed by the CEB and close to 1 900 health care establishments provide access to quality care.

This is the tangible difference that €10 billion of Social Inclusion Bonds can make.