News

2020 Financial Results reflect CEB’s strong performance

02 February 2021

PARIS - During the first year of its Development Plan 2020-2022, marked by the COVID-19 pandemic, the Council of Europe Development Bank (CEB) achieved and strongly exceeded its activity objectives. Its operational framework showcases the CEB’s relevance as a financial partner with a unique social mandate in Europe.

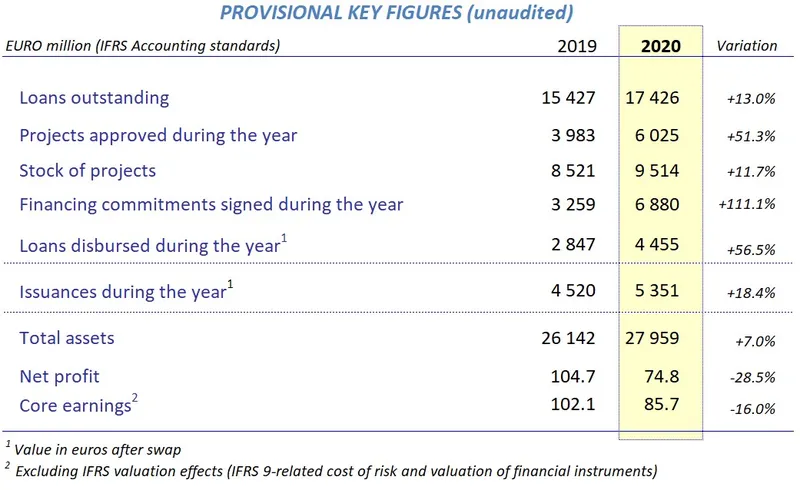

The CEB’s unaudited results show a net financial profit of € 74.8 million in 2020, in line with the Bank’s expectations, compared to € 104.7 million in 2019 (-28.5%) in a challenging economic and financial context. Excluding the valuation effects of the IFRS accounting requirements (IFRS 9-related cost of risk and valuation of financial instruments), core earnings reached € 85.7 million compared to € 102.1 in 2019 (-16.0%) due to the continuous low-interest rate environment. As in previous years, no credit incidents occurred during the 2020 financial year.

In 2020, the CEB’s swift reaction to strong demand triggered by the pandemic translated into a substantial activity level. 56 new projects were approved for a total of € 6.0 billion, of which 52% were dedicated to COVID-19 loans (2019: 46 projects / € 4.0 billion). The stock of projects reached a record level of € 9.5 billion, up 11.7% compared to 2019 (€ 8.5 billion), and loan disbursements amounted to € 4.5 billion (of which 34% were dedicated to COVID-19 loans), an increase of 56.5% compared to 2019 (€ 2.8 billion). Accordingly, outstanding loans rose significantly from € 15.4 billion at year-end 2019 to € 17.4 billion at year-end 2020 (+13.0%). 44% of the total loans outstanding benefitted from credit enhancements, representing € 7.6 billion.

The CEB grew in membership in 2020 with the accession of Andorra as 42nd member state. The Bank’s cooperation policy continued to be based on active partnerships through its trust accounts and donors. The European Union, the Bank’s largest donor, contributed € 90 million for a healthcare project through its Facility for Refugees in Turkey and additional funding to the Regional Housing Programme (RHP), alongside other donors including Norway. The Migrant and Refugee Fund, with projects adapted to the COVID-19 context, has been extended to 2025. Finally, the CEB established the Green Social Investment Fund (GSIF) to contribute to transition towards low-carbon and climate resilient economies.

The CEB’s financial and operational soundness were once more noted by the rating agencies, who acknowledged the Bank’s high volume of activity, prudent risk policies and positive track record in issuing Social Inclusion Bonds, especially those in response to the COVID-19 pandemic. The Bank’s credit rating was reaffirmed as AAA by Standard & Poor’s on July 6, 2020, and Scope Ratings assigned the CEB with its first AAA rating with a 'stable' outlook (unsolicited) on October 2, 2020. Fitch Ratings revised its rating outlook from “positive” to “stable” and affirmed the Bank’s AA+ rating on July 29, 2020. Moody's affirmed its Aa1 rating with a ‘stable’ outlook on July 6, 2020. The Financial Statements will

be submitted to the Bank’s Governing Board for approval in April 2021.

The Financial Statements will

be submitted to the Bank’s Governing Board for approval in April 2021.Set up in 1956, the CEB (Council of Europe Development Bank) has 42 member states. Twenty-two Central, Eastern and South Eastern European countries, forming the Bank's target countries, are listed among the member states. As a major instrument of the policy of solidarity in Europe, the Bank finances social projects by making available resources raised in conditions reflecting the quality of its rating (Aa1 with Moody's, outlook stable, AAA with Standard & Poor's, outlook stable, AA+ with Fitch Ratings, outlook stable and AAA* with Scope Ratings, outlook stable). It thus grants loans to its member states, and to financial institutions and local authorities in its member states for the financing of projects in the social sector, in accordance with its Articles of Agreement.

*unsolicited