News

CEB approves six loans totalling €456 million

30 January 2026

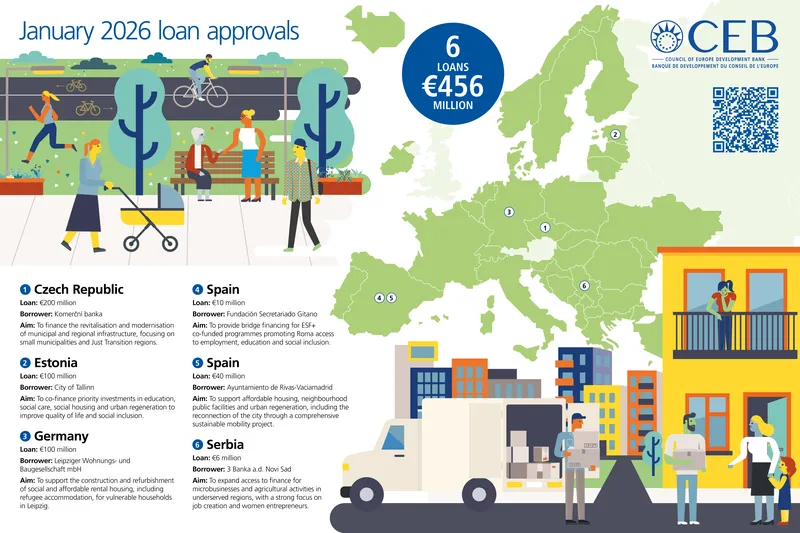

PARIS – The Council of Europe Development Bank (CEB) has approved six loans totalling €456 million to boost social infrastructure and inclusion across Europe. Spanning diverse sectors and beneficiary groups, the financing reflects the breadth of the CEB’s mission and its long-standing support for resilient, inclusive communities.

CZECH REPUBLIC: A €200 million loan to Komerční banka will help modernise and revitalise municipal and regional infrastructure, with a focus on Just Transition regions and small municipalities with under 5 000 residents. Eligible projects include rehabilitation of water and wastewater systems; upgrades to schools and social-care facilities; safety improvements to local roads; energy-efficiency upgrades in public buildings; and the expansion and modernisation of healthcare facilities. The loan builds on a long-standing partnership with Komerční banka: five previous programmes have already benefitted more than two million people across the Czech Republic.

ESTONIA: A €100 million loan to City of Tallinn will co-finance priority municipal infrastructure investments to enhance quality of life, social inclusion and environmental sustainability and urban mobility in the Estonian capital. Priority sub-projects cover investments in educational facilities, including specialised education centres; upgrades to social care and social housing infrastructure; and urban regeneration projects: pedestrian and cycling networks, public spaces, and green areas. The project will benefit children in early childhood education, persons with disabilities, families requiring social support, and individuals in need of social assistance.

GERMANY: A €100 million loan to Leipziger Wohnungs- und Baugesellschaft mbH (LWB) – the City of Leipzig’s municipal housing company – will co-finance the construction and refurbishment of social and affordable rental housing for vulnerable groups, such as low-income households, elderly people, migrants, refugees, and asylum seekers. Building on a previous project that has already improved housing conditions for over 8 000 low-income tenants, the new loan is expected to deliver more than 500 new housing units for over 1 200 residents.

SERBIA: A €6 million additional loan to 3 Banka will further expand microfinance to microbusinesses and agricultural activities in underserved regions. The initial loan, approved in 2024, helped sustain an estimated 3 320 jobs and create 193 new ones. The additional loan will address persistent gaps in access to finance, foster job creation and resilience, and support women, low-income rural entrepreneurs and underbanked entrepreneurs. 3Banka aims to allocate 40% of the loan to women entrepreneurs or women-owned businesses.

SPAIN: A €10 million loan to Fundacion Secretariado Gitano (FSG) will help bridge temporary financing gaps between the launch of FSG’s activities and the delayed reimbursements from the European Social Fund Plus (ESF+), ensuring the continuity of programmes promoting Roma access to employment, youth employability and improved educational outcomes. An estimated 69 000 Roma people – in particular economically vulnerable families, young people, women (57% of beneficiaries), and victims of discrimination –are expected to benefit directly.

SPAIN: A €40 million loan to Ayuntamiento de Rivas Vaciamadrid will address constraints in urban infrastructure bottlenecks and improve access to local services. The CEB loan will support the municipality’s 2030 Agenda by expanding affordable rental housing, developing neighbourhood-based public service facilities, and part-financing the covering of a 2.5 km open metro trench, reconnecting the city and creating a green corridor that promotes sustainable mobility. The project will benefit all residents – particularly young people, low-income families, older people, and persons with disabilities – while contributing to greenhouse gas reduction and delivering highly energy-efficient housing.

The Council of Europe Development Bank (CEB) is a multilateral development bank with an exclusively social mandate from its 43 member countries. The CEB finances investment and provides technical assistance in social sectors such as education, health and affordable housing, while focusing on the needs of vulnerable people, as well as on the social dimensions of climate change and the environment. Borrowers include governments, local and regional authorities, public and private banks, non-profit organisations and others. The CEB, which has a triple-A credit rating, funds itself through international capital markets. In addition, the CEB receives funds from donors to complement its activities.