News

CEB financial results as at 30 June 2023

23 October 2023

Paris - The Council of Europe Development Bank (CEB)’s half-year financial report as at 30 June 2023” shows strong resilience in a challenging financial environment.

The CEB has released today the Half-year Financial Report 2023 on its non-audited condensed interim financial statements with a comparative reference as of 31 December 2022. This report has been issued in compliance with international accounting standard IAS 34 Interim Financial Reporting.

In the first half of the year, the financial situation of the CEB has shown resilience despite a challenging and volatile financial environment. The Bank’s loan activity continued to grow at a sustained pace, in line with the lines of action set out in the Strategic Framework 2023-2027, which guides CEB’s activities.

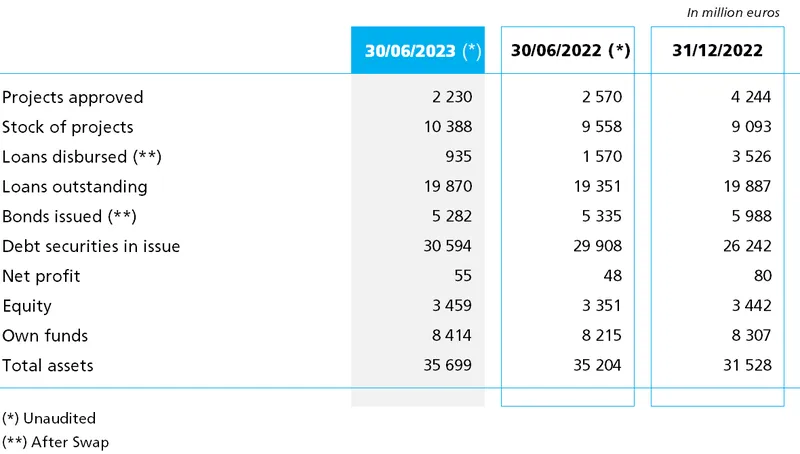

Net profit reached €54.6 million as at 30 June 2023, compared to €48.2 million at the end of June 2022 – an increase of 13.2%. The main driver is the positive evolution in the interest margin (+€9.7 million), owing to higher income from the securities at amortised cost and to the active management of liquidity and interest rate positions. Meanwhile, core earnings stood at €54.2 million, compared to €42.3 million at the end of June 2022 (+28.1%). The two elements outside core earnings – financial instruments valuations and cost of risk – present a volatile but offsetting development in 2023 compared to a positive impact in the first half of 2022.

The CEB’s total balance sheet reached €35.7 billion at the end of June 2023, an increase of 13.2% compared to 31 December 2022 (€31.5 billion), driven by the intra-year cyclical activity in finance/treasury operations.

Loans at fair value in the balance sheet stood at €18.4 billion. Importantly, loans hedged with swaps are recorded at fair value under the hedge accounting principle, and therefore, the accounting value is currently below the nominal value of €19.9 billion.

Meanwhile, equity increased by €16.9 million (+0.5%) primarily by incorporation of the net result of the year 2022, reaching €3.5 billion as at 30 June 2023. The CEB’s Governing Board approved in December 2022 a capital increase to strengthen the Bank’s capital base, by a maximum of €4.25 billion in subscribed capital and €1.2 billion in paid-in capital, that will become effective when 67% of the participating certificates offered have been subscribed. As at 30 June 2023, the subscription rate stood at 41.7%. Ukraine became a fully-fledged member of the Bank in June 2023.

CEB's prudential ratios remained within approved limits throughout the first half of 2023. The Bank did not record any non-performing loans or late payments during the reporting period.

As at 30 June 2023, 22 new projects amounting to €2.2 billion have been approved and loans in the amount of €935 million have been disbursed. The stock of projects approved and awaiting financing reached €10.4 billion, compared to a stock of projects as at 31 December 2022 of €9.1 billion.

In the first half of 2023, new debt issuance in a total amount of €5.3 billion comprised 21 bonds with maturities over one year, compared to 15 bonds in a total amount of €5.4 billion issued in the first half of 2022. Debt issuance included three Social Inclusion Bonds (SIBs) – a €1.0 billion seven-year SIB in April, as well as an inaugural SEK-denominated 650 million five-year SIB and a USD 1.0 billion three-year SIB, both in May. The CEB has been a pioneer in this market ever since the issuance of its first SIB in 2017.

The Council of Europe Development Bank (CEB) is a multilateral development bank, whose unique mission is to promote social cohesion in its 43 member states across Europe. The CEB finances investment in social sectors, including education, health and affordable housing, with a focus on the needs of vulnerable people. Borrowers include governments, local and regional authorities, public and private banks, non-profit organisations and others. As a multilateral bank with an excellent credit rating, the CEB funds itself on the international capital markets. It approves projects according to strict social, environmental and governance criteria, and provides technical assistance. In addition, the CEB receives funds from donors to complement its activities.