News

CEB issues a new 0.750% £300m Benchmark due 22 July 2027

23 January 2020

Highlights

- CEB extends its GBP curve to the 7-year tenor

- The transaction allows CEB to tap into a new investor base within the sterling market

On the 23rd January 2020, CEB successfully priced a new £300m long 7-year GBP benchmark due 22nd July 2027. This new transaction allowed CEB to extend their GBP curve by 5 years from 2022 out to 2027.

The new mandate was announced on Thursday, 23rd January at 09.05 London time with guidance of UKT 1.25% 22/07/2027 + 39bps area.

The orderbook quickly attracted a number of high quality investors, enabling the issuer to release a book update at 11.15am London time stating that books were over £340m (excl. JLM).

An hour later, at 12.16pm London time, given the ongoing demand, a further update was announced to the market, setting the spread at UKT +38bps with books over £425m. This enabled the issuer to set the deal size to £300m.

The transaction was priced shortly after 15.00pm London time with an annual coupon of 0.750% and a re-offer price of 99.339%, equating to a re-offer yield of 0.840% (semi-annual).

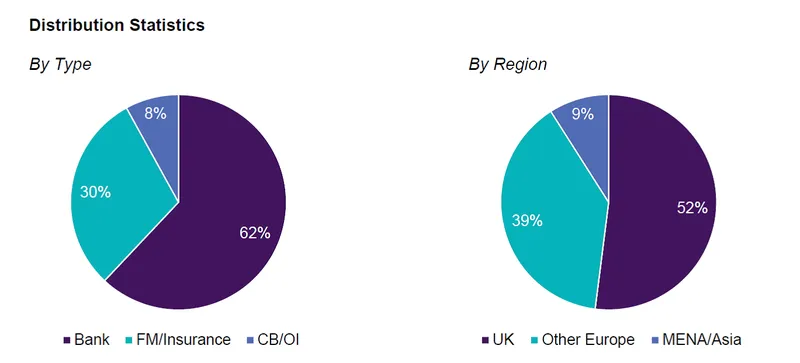

The deal attracted broad interest both geographically and by investor type, with just under 50% of the orderbook coming from non-UK investors.

Set up in 1956, the CEB (Council of Europe Development Bank) has 41 member states. Twenty-two Central, Eastern and South Eastern European countries, forming the Bank's target countries, are listed among the member states. As a major instrument of the policy of solidarity in Europe, the Bank finances social projects by making available resources raised in conditions reflecting the quality of its rating (AA+ with Fitch Ratings, outlook positive, AAA with Standard & Poor's, outlook stable and Aa1 with Moody's, outlook stable). It thus grants loans to its member states, and to financial institutions and local authorities in its member states for the financing of projects in the social sector, in accordance with its Articles of Agreement.

Contact

-

Magnus Sandin/Felix Grote

+33 1 47 55 71 10/+33 1 47 55 55 28