News

CEB’s preliminary results point to strong operational and financial performance in 2024

05 February 2025

PARIS – The Council of Europe Development Bank (CEB)’s preliminary (unaudited) financial results for 2024, published today, reflect its solid level of activity in social investment, improved resilience and robust balance sheet in a challenging economic context.

- New project approvals stand at €4.5 billion in 2024, including €303 million for Ukraine

- CEB net profit rises to €124.3 million for the financial year

- Capital increase closes successfully with a very high participation rate

- Social Inclusion Bonds total issuances surpass €10 billion mark

- CEB retains triple-A rating

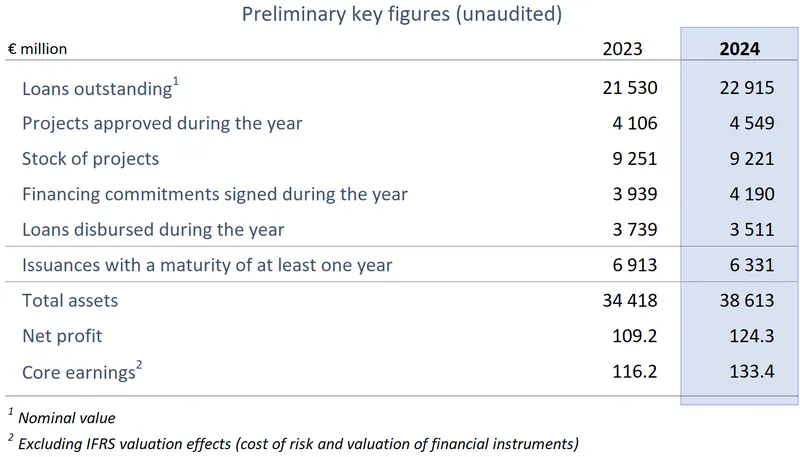

The CEB approved €4.5 billion of new projects in 2024, compared to €4.1 billion in 2023, while €3.6 billion of loans were disbursed, compared to €3.7 billion in 2023. The portfolio of loans outstanding reached €22.9 billion at the end of 2024, which represented a 6.4% increase compared to the end of 2023. For Ukraine, the CEB approved €303 million in direct loans in 2024, bringing the overall amount of loans approved for the country, since its accession to the Bank in June 2023, to €403 million. The amount of loans already disbursed in Ukraine was €116 million at the end of 2024.

The CEB’s net financial profit reached €124.3 million for the year 2024, an increase of 13.8% compared to 2023. Core earnings, which exclude volatile elements such as the cost of risk and the valuation of financial instruments, reached €133.4 million at the end of 2024, which represented an increase of 14.8% compared to 2023.

The reporting period was marked by key milestones. First, the CEB’s 7th capital increase subscription period successfully closed on 31 December 2024, two years after the historic approval by the Bank’s Governing Board of a first-ever capital increase with paid-in capital. With a shareholders’ participation rate of over 95%, the CEB’s subscribed capital will rise to €9.623 billion and the paid-in capital to €1.766 billion. Such a high participation rate demonstrates the membership’s strong confidence in the CEB’s social mandate, equipping the Bank to deliver on its Strategic Framework, particularly operations in Ukraine.

On funding, total issuances of the CEB’s trademark Social Inclusion Bonds (SIBs) since its launch in 2017 surpassed €10 billion in 2024, which is seen as a testimony to the Bank’s strong market access and pioneering contribution to creating social impact through sustainable finance.

Moreover, the CEB’s triple-A credit rating was confirmed for 2024 by leading rating agencies Fitch, Moody’s, S&P Global and Scope, citing such factors as its strong shareholder support, improved capitalisation, low credit risk with stringent risk management and proven public policy role.

Preliminary unaudited accounting figures indicate that the Bank complied with all of the prudential ratios established in the CEB’s Risk Appetite Framework at year-end 2024. The credit quality of the Bank’s loan portfolio continued to be solid, with no credit default, credit risk event or late payment recorded, in line with previous years.

The Financial Statements for the year ended 31 December 2024 will be submitted to the CEB’s Governing Board for approval in April 2025.

See also: CEB Half-year Financial Report 2024

Visit Financial reporting

The Council of Europe Development Bank (CEB) is a multilateral development bank, whose unique mission is to promote social cohesion in its 43 member states across Europe. The CEB finances investment in social sectors, including education, health and affordable housing, with a focus on the needs of vulnerable people. Borrowers include governments, local and regional authorities, public and private banks, non-profit organisations and others. As a multilateral bank with an excellent credit rating, the CEB funds itself on the international capital markets. It approves projects according to strict social, environmental and governance criteria, and provides technical assistance. In addition, the CEB receives funds from donors to complement its activities.

Related publications

-

Interim financial report 2024

Explore the Council of Europe Development Bank's (CEB) financial performance in the first half of 2024 in this … Published: October 2024 Read