News

CEB reports strong financial performance in 2021 Results

31 January 2022

PARIS – The Council of Europe Development Bank (CEB) has encountered a strong demand for financing in the second year of its Development Plan 2020-2022. With a solid operational performance, the CEB strengthened its position as a social development bank within the European financial architecture.

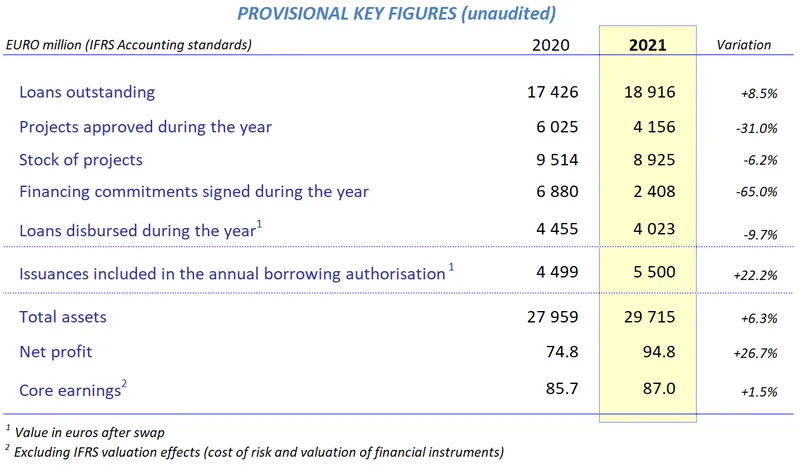

The CEB’s unaudited results for the financial year 2021 show a net financial profit of € 94.8 million, compared to € 74.8 million in 2020 (+26.7%). The partial release of IFRS provisioning related to the impact of COVID-19 has been a determinant of the increase of the CEB’s net profit. Disregarding the valuation effects of the IFRS accounting requirements (IFRS 9-related cost of risk and valuation of financial instruments), core earnings reached € 87.0 million compared to € 85.7 million in 2020 (+1.5%). This result was achieved despite challenging market conditions. As in previous years, no credit incidents were recorded in the 2021 financial year.

After a historic high in activity in 2020 due to the COVID-19 pandemic, the CEB’s activity levels in 2021 smoothly transitioned back to the targets set out in its current Development Plan. In total, 57 projects worth € 4.2 billion were approved, of which 16% were dedicated to COVID-19 loans (2020: 56 projects / € 6.0 billion), contributing to a reduction in the stock of projects at € 8.9 billion, down 6.2% compared to 2020 (€ 9.5 billion). Loan disbursements amounted to € 4.0 billion (including 37% for assisting CEB member states in facing the pandemic), a decline of 9.7% compared to 2020 (€ 4.5 billion). The high volume of COVID-19-related disbursements in 2020 and 2021 contributed to an increase in outstanding loans to € 18.9 billion at year-end 2021 (+8.5%). As part of its funding activity, the CEB issued two Social Inclusion Bonds in 2021 to support social investments across Europe.

Recognising the importance of concerted action to achieve sustainable and inclusive growth, the Bank continued in 2021 to forge partnerships with international organisations, in particular the European Union, its largest donor. The CEB applied to become an implementing partner of the InvestEU loan guarantee facility and established two joint initiatives with the European Union: Housing and Empowerment of Roma (HERO) and Partnerships and Financing for Migrant Inclusion (PAFMI). These initiatives in favour of Roma and migrants exemplify the Bank’s cooperation with donors: the CEB uses funds raised from donors to support more projects in favour of highly vulnerable groups, in particular migrants and refugees.

The major credit rating agencies emphasised the CEB’s strong financial profile in 2021. Standard & Poor’s reaffirmed the CEB’s creditworthiness at AAA with a ‘stable’ outlook on July 23, 2021 as did Scope Ratings (unsolicited rating) on September 17, 2021. On July 26, 2021 Fitch Ratings revised the CEB’s outlook from ‘stable’ to ‘positive’ while maintaining CEB’s AA+ rating, based on the resilience of the Bank’s financial profile. Moody’s maintained its Aa1 rating for the CEB with a ‘stable’ outlook on August 3, 2021. CEB’s rating strengthens its institutional profile and reflects high shareholder support.

The Financial Statements will be submitted to the Bank’s Governing Board for approval in April 2022.

The Financial Statements will be submitted to the Bank’s Governing Board for approval in April 2022.

Set up in 1956, the CEB (Council of Europe Development Bank) has 42 member states. Twenty-two Central, Eastern and South Eastern European countries, forming the Bank's target countries, are listed among the member states. As a major instrument of the policy of solidarity in Europe, the Bank finances social projects by making available resources raised in conditions reflecting the quality of its rating (Aa1 with Moody's, outlook stable, AAA with Standard & Poor's, outlook stable, AA+ with Fitch Ratings, outlook positive and AAA* with Scope Ratings, outlook stable). It thus grants loans to its member states, and to financial institutions and local authorities in its member states for the financing of projects in the social sector, in accordance with its Articles of Agreement.

*unsolicited