News

Financial Results as at 30 June 2016

26 September 2016

PARIS - The half-year report entitled “Condensed Interim Financial Statements as at 30 June 2016” is now available online.

In accordance with IAS 34 standard “Interim Financial Reporting”, the CEB publishes an Interim Report on its non-audited condensed half-year accounts which is structured in a manner similar to that of the Annual Report.

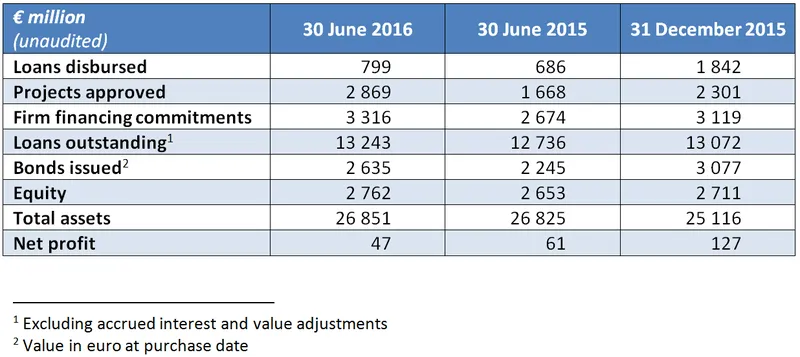

In an economic and financial environment that remains challenging throughout Europe, the CEB approved 26 new projects for a total amount of € 2 869 million during the first half of 2016, a significant increase of 72% compared to the first half of 2015, mainly due to accelerating lending activity, which is also linked to the migrant and refugee crisis. Loan disbursements totalled € 799 million during the first half of 2016, a year-on-year increase of 17%.

The CEB’s unaudited net profit for the first half of 2016 reached € 46.9 million, i.e. a decrease of 23% compared to the first half of 2015, primarily related to:

- a negative variation in the mark-to-market value of financial instruments of € 9.9 million, and

- a decrease of € 4.5 million in interest margin.

Operating expenses remained stable at € 23.4 million.

The CEB’s total assets reached € 26 851 million, increasing by 6.9% compared to year-end 2015, primarily due to:

- outstanding loans amounting to € 13 732 million, i.e. + 2.4% compared to year-end 2015, and

- liquid assets totalling € 8 033 million, i.e. + 26.7% compared to year-end 2015 (€ 6 342 million), mostly due to the increase in money market deposits.

Equity increased by 1.9% since year-end 2015 to reach € 2 762 million.

Since the beginning of 2016, the CEB has launched five issues with a total principal amount of € 2.6 billion, representing 80% of the 2016 borrowing authorisation of € 3.3 billion.

Set up in 1956, the CEB (Council of Europe Development Bank) has 41 member states. Twenty-two Central, Eastern and South Eastern European countries, forming the Bank's target countries, are listed among the member states. As a major instrument of the policy of solidarity in Europe, the Bank finances social projects by making available resources raised in conditions reflecting the quality of its rating (Aa1 with Moody's, outlook stable, AA+ with Standard & Poor's, outlook stable and AA+ with Fitch Ratings, outlook stable). It thus grants loans to its member states, and to financial institutions and local authorities in its member states for the financing of projects in the social sector, in accordance with its Articles of Agreement.