News

Financial Results as at 30 June 2020

14 October 2020

PARIS - The half-year report “Condensed Interim Financial Statements as at 30 June 2020” of the Council of Europe Development Bank (CEB) is now available online.

In compliance with IAS 34 “Interim Financial Reporting” standard, the CEB has released today the Half-year Report of its non-audited condensed interim accounts with a comparative reference as of 31 December 2019, taking into account the provisioning requirements related to the application of IFRS 9.

Despite the COVID-19 pandemic and its economic and financial repercussions, the CEB achieved a sound operational performance, which was marked by a higher level of activity than the previous year and exceeding the objectives of the CEB Development Plan 2020-2022. In the first half of 2020, the Bank provided considerable additional financing to help its members mitigate the health, economic and social consequences of the pandemic.

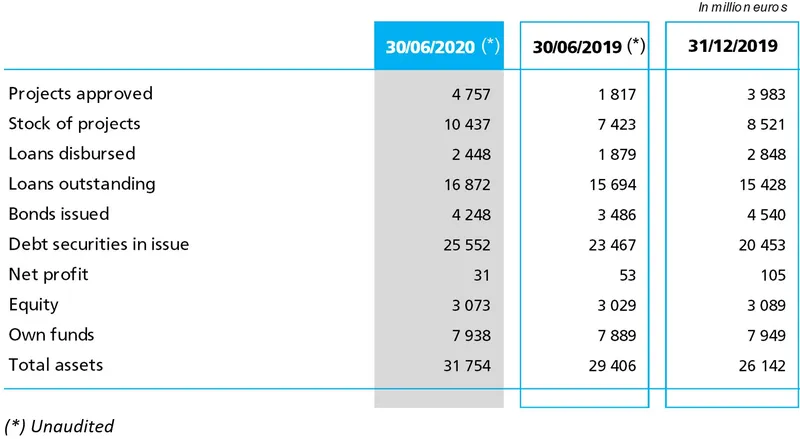

The stock of projects approved by the CEB awaiting financing amounted to € 10.4 billion as at 30 June 2020 compared to € 8.5 billion as at 31 December 2019. A total of 37 new projects worth € 4.8 billion were approved in the first half of 2020 (30 June 2019: € 1.8 billion). Of these, 15 were COVID-19 related emergency projects to support CEB member countries during the crisis and in the recovery period.

A total of 68 loan disbursements were made for an amount of € 2.4 billion in the six-month period ending on 30 June 2020, compared with 63 loan disbursements for a total of € 1.9 billion during the first half of 2019.

The CEB’s unaudited net profit for the six months ending 30 June 2020 amounted to € 30.9 million. This represents a decrease of € 21.7 million (41.3%) compared to the same period in 2019, mainly due to the negative variation in the cost of risk (€ 10.5 million), a decrease in the net interest margin (€ 5.2 million) and the negative impact in the IFRS valuation of financial instruments (€ 3.9 million). Operating expenses in the first half of 2020 amounted to € 26.9 million, increasing by 8.8% compared to the first half of 2019.

The CEB’s total assets reached € 31.8 billion and increased by € 5.6 billion from € 26.1 billion at 31 December 2019, mainly due to the growth of the loan portfolio (+ € 1.6 billion) and additional treasury assets (+ € 3.9 billion), backed by an increase in long-term debt as a result of the Bank’s high level of issuance activity.

Since the beginning of 2020, the CEB has issued 10 bonds with a principal amount of € 4.2 billion, representing 94% of the 2020 long-term borrowing authorisation of € 4.5 billion approved by the CEB’s Administrative Council. Among these 10 bonds, the CEB issued two COVID-19 Response Social Inclusion Bonds in the amounts of € 1 billion and USD 500 million.

The Bank’s equity decreased by € 15.5 million since 31 December 2019 and reached € 3 073 million.

The prudential ratios of the Bank remained within their respective limits throughout the period in question.

Set up in 1956, the CEB (Council of Europe Development Bank) has 42 member states. Twenty-two Central, Eastern and South Eastern European countries, forming the Bank's target countries, are listed among the member states. As a major instrument of the policy of solidarity in Europe, the Bank finances social projects by making available resources raised in conditions reflecting the quality of its rating (Aa1 with Moody's, outlook stable, AAA with Standard & Poor's, outlook stable, AA+ with Fitch Ratings, outlook stable and AAA* with Scope Ratings, outlook stable). It thus grants loans to its member states, and to financial institutions and local authorities in its member states for the financing of projects in the social sector, in accordance with its Articles of Agreement.

* unsolicited