News

Governing Board approves Report of the Governor 2019

03 April 2020

PARIS - The Governing Board of the Council of Europe Development Bank (CEB) approved today the Report of the Governor and the CEB’s financial statements for the year 2019.

The CEB achieved and exceeded its business objectives during the final year of the Development Plan 2017-2019, experiencing a high level of activity which underscores the Bank’s increasing relevance and continued efforts to serve a distinctive social mandate in Europe.

Specifically:

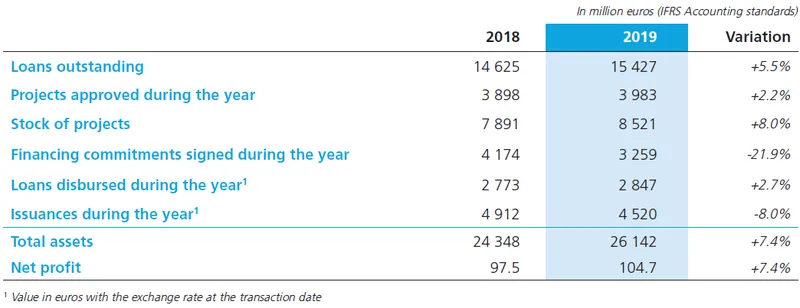

- The volume of projects approved was comparable to the previous year’s record number: € 4.0 billion in loans approved for 24 member countries, which is expected to leverage € 13.9 billion in total investments across Europe.

- Climate action projects account for 26% of the financing approved compared to 16% in 2018 and 8% in 2017.

- The stock of projects awaiting financing reached € 8.5 billion, a strong increase compared to 2018 (+8.0%).

- Loan disbursements amounted to € 2.8 billion, a slight increase compared to 2018, while outstanding loans reached € 15.4 billion (+5.5%).

- Funds raised on international capital markets totalled € 4.5 billion, including

- € 500 million raised through a Social Inclusion Bond with a seven-year maturity.

- The net profit for the financial year 2019 amounted to € 104.7 million, up by 7.4% compared to 2018 (€ 97.5 million). The profit was allocated to the Bank’s reserves, except for € 5 million allocated to the Social Dividend Account and € 5 million apportioned to the newly established Green Social Investment Fund.

In 2019, sustainable and inclusive growth was one of the CEB’s major lines of action along with its support for migrants, refugees and displaced persons. Environmental sustainability, a key priority for the Bank, was also reflected in the CEB’s project portfolio, gradually being aligned with the Paris Agreement on Climate Change.

The increase in sub-national borrowers attests to the CEB’s commitment to supporting the development of inclusive and sustainable European cities and regions, with a focus on enabling economic and social inclusion, improving living conditions, and enhancing diversity. In this connection, access to affordable financing solutions for micro-, small and medium-sized enterprises, improvement of urban and rural infrastructure, supporting education and vocational training, as well as social housing and healthcare solutions were promoted as key areas of operation for the Bank.

The CEB further expanded its European and international cooperation through joint initiatives such as Regions4Integration, led by the European Committee of Regions for the Integration of Migrants, and the Urban Partnership for the Inclusion of Migrants and Refugees. In 2019, the CEB was proposed as implementing partner by the European Commission for the InvestEU Fund, which is to replace the European Fund for Strategic Investments from 2021 onwards. Other initiatives are the Harmonized Indicators for Private Sector Operations (HIPSO), the WHO-founded Social Health Protection Network (P4H), the European Association of Service Providers for Persons with Disabilities (EASPD) and the OECD-led World Observatory on Subnational Governance Finance and Investment.

The CEB also maintained a focus on active partnerships with donors and raised additional funds for its fiduciary activity with additional pledges from the EU for the Regional Housing Programme (RHP) – the CEB’s flagship grant-based project – and steadfast support from bilateral donors such as Germany, Norway, the Slovak Republic, Spain and Switzerland. In total, the Bank awarded € 54 million in grants.

As regards its funding activity in 2019, the CEB launched eleven issuances for a volume of € 4.5 billion (2018: € 4.9 billion), capitalising on its strong track-record as a regular bond issuer across Europe.

The CEB’s financial performance is underpinned by a robust prudential framework; all ratios were well within their defined limits throughout the year 2019. The net profit reached € 104.7 million, up by 7.4%. Core earnings (excluding cost of risk and IFRS-related valuation of financial profits) amounted to € 102.1 million (2018: € 100.5 million). The CEB’s equity rose to € 3 088.8 million at year-end 2019 compared to € 3 023 million at year-end 2018 (+2.2%) due to the impact of the 2019 net profit (+€ 104.7 million) and the positive effects of IFRS 9 phase 3 implementation as of 1 January 2019 (+€ 6.1 million), partially offset by the changes in values of assets and liabilities recognised directly in equity (-€ 45.2 million).

In light of its solid overall performance, the excellent ratings assigned by leading credit rating agencies [1] as well as by Environmental, Social, and Governance rating agencies [2] highlight the Bank’s increased relevance as a funding contributor and its ability to deliver strong results, even in a challenging environment in Europe.

The CEB’s allocation of the 2019 net profit approved by the Governing Board includes € 5 million to the Social Dividend Account and € 5 million to the Green Social Investment Fund. This new fund was created to facilitate climate action measures for the benefit of vulnerable groups. The balance of the net profit will be apportioned to the general reserves.

The Development Plan 2020-2022 formulates the CEB’s strategy for the coming years with a focus on strengthening inclusive growth, supporting vulnerable groups and ensuring environmentally sustainable investments in alignment with the UN Sustainable Development Goals.

The CEB also stands ready to assist countries in tackling the health and economic challenges resulting from the COVID-19 pandemic.

Key figures

[1] On 3 September 2019, Fitch Ratings revised the outlook for the CEB from ‘stable’ to ‘positive’ and on 15 February 2019, Standard & Poor’s upgraded the CEB’s rating from ‘AA+, outlook positive’ to ‘AAA, outlook stable’.

[2] B- (‘Prime’) rating was awarded by ISS ESG; AA (“Leader”) affirmed by MSCI ESG and ‘Outperformer’ by Sustainalytics.

Set up in 1956, the CEB (Council of Europe Development Bank) has 41 member states. Twenty-two Central, Eastern and South Eastern European countries, forming the Bank's target countries, are listed among the member states. As a major instrument of the policy of solidarity in Europe, the Bank finances social projects by making available resources raised in conditions reflecting the quality of its rating (AA+ with Fitch Ratings, outlook positive, AAA with Standard & Poor's, outlook stable and Aa1 with Moody's, outlook stable). It thus grants loans to its member states, and to financial institutions and local authorities in its member states for the financing of projects in the social sector, in accordance with its Articles of Agreement.

Related publications

-

Activity Report 2019

Explore the Council of Europe Development Bank's (CEB) activities and achievements in 2019. This report details how the … Published: April 2020 Read -

Financial Report 2019

Discover the Council of Europe Development Bank's (CEB) financial performance and activities in 2019 in its Financial Report.In … Published: April 2020 Read