News

Results for financial year 2014

19 February 2015

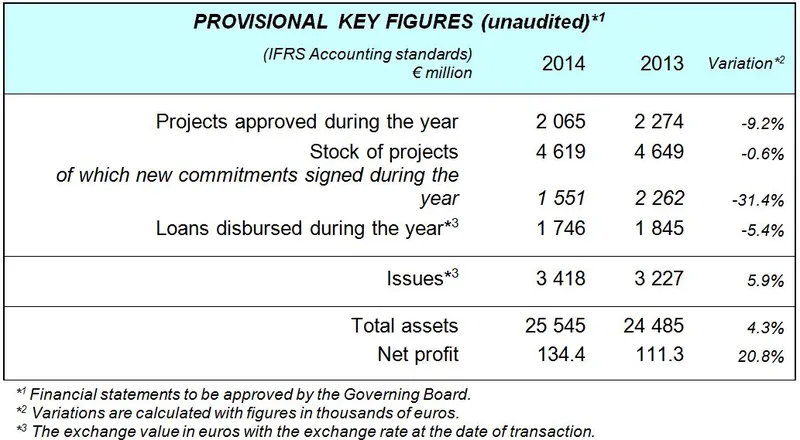

PARIS - In 2014, the Council of Europe Development Bank (CEB) achieved its activity objectives with an overall satisfactory financial performance. The Bank successfully reached the targets set for the first year of the Development Plan 2014-2016, efficiently pursuing its social mandate in Europe.

Although not yet audited, the CEB’s 2014 net profit reached a record high of € 134.4 million, compared to € 111.3 million in 2013 (+20.8%). This is mainly due to the increase in the net interest margin (€ 6 million) as well as the positive impact of the financial instruments at fair value through profit and loss (IAS 39) (€ 7 million) and the positive development of general operating expenses (€ 10 million), of which € 7.7 million related to post-employment benefits (adjustment related to cost for medical coverage). Excluding special items, core earnings amounted to € 127.4 million in 2014 compared to € 123.0 million in 2013, i.e. an increase of 3.6%. Equity rose by 4.3% from € 2.5 billion to € 2.6 billion (after profit allocation).

In 2014, € 2.1 billion worth of new projects were approved, more than a third of which (37%) with the objective of facilitating the creation and preservation of viable jobs in micro-, small- and medium-sized enterprises in the CEB’s Member States. Loans outstanding amounted to € 12.6 billion, 59% of which were extended for the benefit of the CEB’s target countries (marked by an asterisk in the list on the left), remaining stable versus 2013. The stock of projects remained at € 4.6 billion, unchanged compared to year-end 2013.

Set up in 1956, the CEB (Council of Europe Development Bank) has 41 member states. Twenty-two Central, Eastern and South Eastern European countries, forming the Bank's target countries, are listed among the member states. As a major instrument of the policy of solidarity in Europe, the Bank finances social projects by making available resources raised in conditions reflecting the quality of its rating (Aaa with Moody's, outlook negative, AA+ with Standard & Poor's, outlook stable and AA+ with Fitch Ratings, outlook stable). It thus grants loans to its member states, and to financial institutions and local authorities in its member states for the financing of projects in the social sector, in accordance with its Articles of Agreement.