News

Results for financial year 2015

12 February 2016

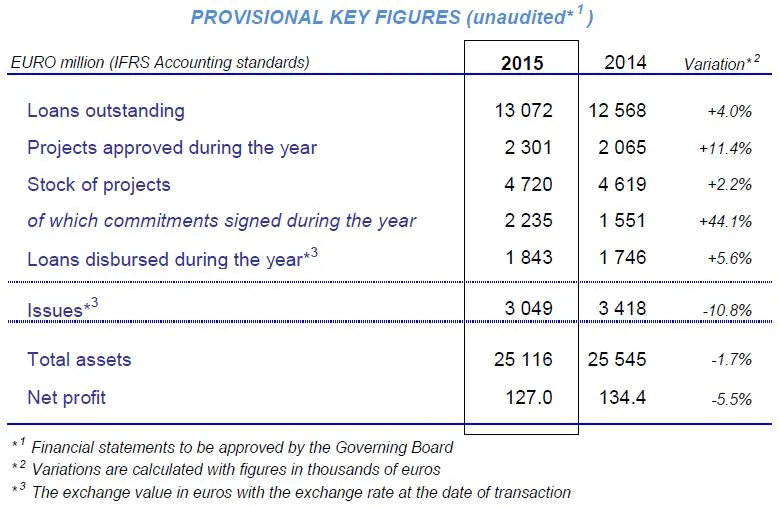

The CEB’s unaudited results show that net profit for 2015 reached € 127.0 million, the second highest level in the CEB’s history, after € 134.4 million in 2014 (-5.5%). Excluding an exceptional profit of € 7.7 million recorded in 2014 following a change in medical coverage for pensioners, net profit for 2015 remained stable in comparison with 2014. Net banking income in 2015 increased by € 6.7 million (or +4.0%) compared with 2014. This was due primarily to a positive impact of the valuation of financial instruments (IFRS) (+ € 9.4 million), partly offset by a slight decrease in net interest margin (- € 2.7 million), which mainly resulted from the contraction of fixed-income revenues on the held-to-maturity portfolio. Equity rose by 6.5% from € 2.6 billion as at 31 December 2014 to € 2.7 billion at the end of 2015 after profit allocation.

In 2015, € 2.3 billion worth of new projects were approved (+11.4% compared with 2014), of which two-thirds were dedicated to the CEB’s target countries. At the end of 2015, loans outstanding increased to € 13.1 billion (+4.0% compared with the end of 2014), 58% of which benefited CEB target countries. At the end of 2015, the stock of projects amounted to € 4.7 billion (+2.2% compared with the end of 2014) and loan disbursements reached € 1.8 billion (+5.6% compared with the end of 2014).

Set up in 1956, the CEB (Council of Europe Development Bank) has 41 member states. Twenty-two Central, Eastern and South Eastern European countries, forming the Bank's target countries, are listed among the member states. As a major instrument of the policy of solidarity in Europe, the Bank finances social projects by making available resources raised in conditions reflecting the quality of its rating (Aa1 with Moody's, outlook stable, AA+ with Standard & Poor's, outlook stable and AA+ with Fitch Ratings, outlook stable). It thus grants loans to its member states, and to financial institutions and local authorities in its member states for the financing of projects in the social sector, in accordance with its Articles of Agreement.