News

The Governing Board approves CEB’s 2021 Financial Statements and the Report of the Governor

08 April 2022

PARIS - The Governing Board of the Council of Europe Development Bank (CEB) approved today the CEB’s audited financial statements for 2021. The Report of the Governor will be published shortly.

Highlights:

- Activity levels aligned with the objectives set in the CEB’s Development Plan 2020-2022 after the upswing in 2020 due to the COVID-19 emergency

- Strengthened cooperation and partnerships for impactful and targeted financing

- Two new Social Inclusion Bonds, reaffirming CEB’s leadership as social bond issuer

- A sound financial profile in 2021 as confirmed by the major rating agencies

During the second year of its Development Plan 2020-2022, the CEB continued to support its member countries in addressing social, economic and environmental objectives while keeping the Bank’s prudential framework within its internal limits.

The Bank approved € 4.2 billion in loans over 57 projects, a noticeable proportion of which related to the COVID-19 pandemic (€ 657 million or 16%) reaffirming the CEB’s solid lending activity in targeted sectors which contribute to the promotion of social inclusion and growth in Europe.

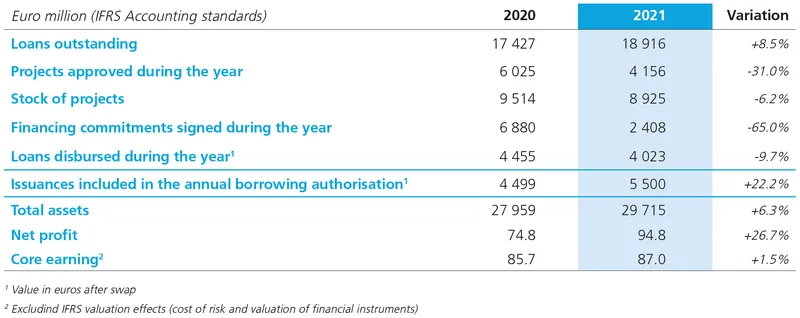

Loans disbursed amounted to € 4.0 billion. The high volume of COVID-19 related disbursements in 2020 and 2021 contributed to a significant rise in outstanding loans to € 18.9 billion (+8.5% / € 17.4 billion in 2020) that spread over 36 countries. CEB’s stock of projects awaiting financing reached € 8.9 billion, compared to € 9.5 billion at the end of 2020 (-6.2%), 43% of which related to Target Group countries [1].

According to the audited results presented to the Governing Board at its 231st meeting, the CEB showed a strong financial and operational performance and maintained rigorous risk management for its funding and loan activities in 2021. In compliance with the International Financial Reporting Standards adopted by the European Union, the CEB’s audited financial statements show a net profit for the year 2021 amounting to € 94.8 million, compared to € 74.8 million in 2020 (+26.7%). However, core earnings (excluding IFRS-related valuation of financial instruments and cost of risk) increased only by 1.5%, reaching € 87.0 million (€ 85.7 million in 2020). The net profit of 2021 was fully allocated to the Bank’s general reserves.

In 2021, 19 issuances were launched by the Bank, including two Social Inclusion bonds, for a volume of € 4.6 billion. Together with € 0.9 billion issued in October 2020 as pre-financing on the 2021 borrowing authorisation, the CEB's annual borrowing authorisation (€ 5.5 billion) was fully utilised.

In addition to its natural ties with the Council of Europe, the CEB continued to strengthen its cooperation with multilateral financial institutions and international organisations. The CEB’s long-standing partnership with the European Union was solidified in 2021 through the application to the InvestEU loan guarantee facility and by the establishment of two initiatives jointly funded with the EU: Housing and Empowerment of Roma (HERO) and Partnerships and Financing for Migrant Inclusion (PAFMI). The CEB also joined other multilateral banks in aligning its goals with the Paris Agreement on Climate (COP26).

The close of 2021 also marked the CEB’s 65 years of illustrious history in social investment. In the current context, as Europe finds itself confronted with the war in Ukraine -and the fastest growing refugee influx since World War II- the CEB remains committed and determined to support its member countries which share borders with Ukraine and beyond, to cope with the humanitarian and refugee crisis.

[1] As a sign of solidarity among CEB member states, the Bank aims to provide increased support to a group of twenty-two Central, Eastern and South Eastern European countries forming the “target countries” (Albania, Bosnia and Herzegovina, Bulgaria, Croatia, Cyprus, Czech Republic, Estonia, Georgia, Hungary, Kosovo, Latvia, Lithuania, Malta, Moldova (Republic of), Montenegro, North Macedonia, Poland, Romania, Serbia, Slovak Republic, Slovenia, and Turkey).

Set up in 1956, the CEB (Council of Europe Development Bank) has 42 member states. Twenty-two Central, Eastern and South Eastern European countries, forming the Bank's target countries, are listed among the member states. As a major instrument of the policy of solidarity in Europe, the Bank finances social projects by making available resources raised in conditions reflecting the quality of its rating (Aa1 with Moody's, outlook stable, AAA with Standard & Poor's, outlook stable, AA+ with Fitch Ratings, outlook positive and AAA* with Scope Ratings, outlook stable). It thus grants loans to its member states, and to financial institutions and local authorities in its member states for the financing of projects in the social sector, in accordance with its Articles of Agreement.

*unsolicited

Related publications

-

Activity Report 2021

Discover the Council of Europe Development Bank's (CEB) activities and achievements in 2021 in its Activity Report. This … Published: April 2022 Read -

Financial Report 2021

Explore the Council of Europe Development Bank's (CEB) financial performance in 2021 in its Financial Report. In a … Published: April 2022 Read