Actualités

CEB issues a new 0.750% £300m Benchmark due 22 July 2027

23 janvier 2020

Highlights

- CEB extends its GBP curve to the 7-year tenor

- The transaction allows CEB to tap into a new investor base within the sterling market

On the 23rd January 2020, CEB successfully priced a new £300m long 7-year GBP benchmark due 22nd July 2027. This new transaction allowed CEB to extend their GBP curve by 5 years from 2022 out to 2027.

The new mandate was announced on Thursday, 23rd January at 09.05 London time with guidance of UKT 1.25% 22/07/2027 + 39bps area.

The orderbook quickly attracted a number of high quality investors, enabling the issuer to release a book update at 11.15am London time stating that books were over £340m (excl. JLM).

An hour later, at 12.16pm London time, given the ongoing demand, a further update was announced to the market, setting the spread at UKT +38bps with books over £425m. This enabled the issuer to set the deal size to £300m.

The transaction was priced shortly after 15.00pm London time with an annual coupon of 0.750% and a re-offer price of 99.339%, equating to a re-offer yield of 0.840% (semi-annual).

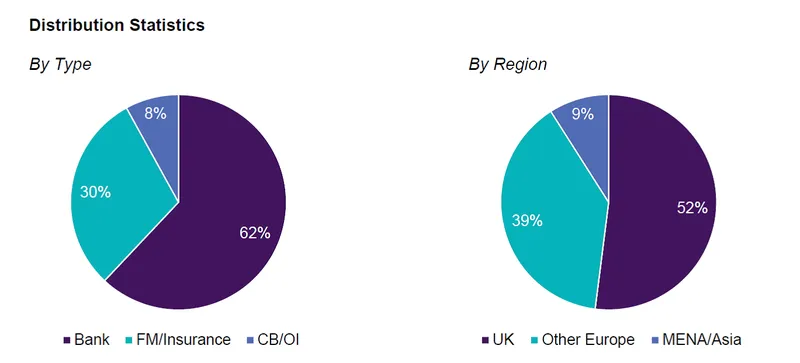

The deal attracted broad interest both geographically and by investor type, with just under 50% of the orderbook coming from non-UK investors.

Fondée en 1956, la CEB (Banque de Développement du Conseil de l'Europe) compte 41 États membres, dont 22 pays d'Europe centrale, orientale et du Sud-Est formant les pays cibles de la Banque. En tant qu'instrument majeur de la politique de solidarité en Europe, la Banque finance des projets sociaux en mettant à leur disposition des ressources levées dans des conditions reflétant la qualité de sa notation (AA+ auprès de Fitch Ratings, perspective positive, AAA auprès de Standard & Poor's, perspective stable et Aa1 auprès de Moody's, perspective stable). Elle accorde des prêts à ses États membres, à des établissements financiers et à des autorités locales pour le financement de projets dans le secteur social, conformément à son Statut.

Contact

-

Magnus Sandin/Felix Grote

+33 1 47 55 71 10/+33 1 47 55 55 28