CEB and climate change

The climate crisis is increasingly exposing and exacerbating inequalities, as the groups most vulnerable to climate change are generally the least resilient to its economy-wide impacts and may bear a disproportionate burden in the low-carbon transition.

As a social development bank, the CEB addresses the social impacts of climate change, particularly on the most vulnerable, while seeking to achieve benefits for climate goals in its social projects. This is in line with the Council of Europe’s Reykjavík Declaration (May 2023) in which the Heads of State and Government called up the Bank “to focus on the social dimensions of climate change and environmental degradation, and to help member states achieve a fair and inclusive transition that leaves no one behind.”

Strategic Framework 2023-2027

To address climate considerations, as underlined in the Strategic Framework 2023-2027, the Bank is committed to (i) apply the climate-social nexus approach to social investment to achieve greater impact, with a focus on financing activities that enhance the climate resilience of vulnerable populations and support communities’ responses to climate-related and other disasters, and to (ii) align its activities with the Paris Agreement and ensure compatibility with climate goals.

In 2024, the CEB pursued its climate mitigation and adaptation activities, through the implementation of its Paris alignment roadmap, climate change due diligence and climate finance.

Aligning with the Paris Agreement

Since 2021 the CEB has been implementing its comprehensive Paris Alignment Framework and Roadmap endorsed by the Administrative Council.

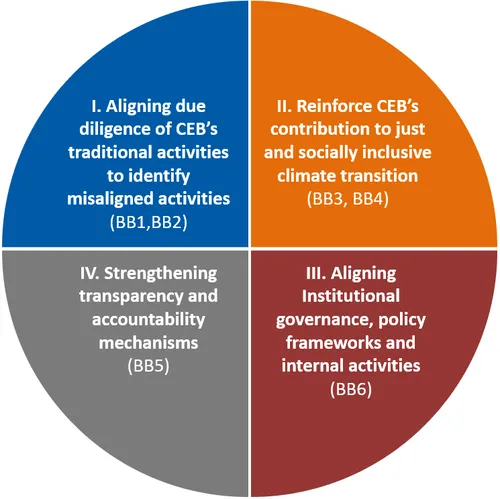

The Framework developed by the CEB to align its activities with the objectives of the Paris Agreement covers both its project financing and internal activities. Among its four key dimensions, the first dimension focuses on applying the do no significant harm principle to the financing of projects, in line with low-carbon and climate resilience goals. To keep upholding the CEB’s social mandate, the second dimension of the framework demands a focus on opportunities which simultaneously promote social inclusion and climate-related objectives. The third dimension addresses the alignment of internal activities and governance mechanisms and policies, and the fourth dimension aims to enhance transparency and reporting on climate-related topics.

The CEB discloses its progress towards alignment with the Paris Agreement in its annual TCFD report.

Joint MDB Methodological Principles for Assessment of Paris Agreement Alignment of New operations

In 2023, the Multilateral Development Banks (MDBs), including the CEB, released methodologies to align their activities with the goals of the Paris Agreement. These methodologies establish principles for assessing the MDBs’ operations with regards to climate mitigation and adaptation objectives, taking into account the unique contexts of each MDB. The Paris alignment assessments at the CEB are based on these joint MDB principles.

- Direct Investment Lending Operations

- Intermediated Financing

- General Corporate Purpose Financing

- Policy-based Lending Operations

- List of Activities Considered Universally Aligned with the Paris Agreement’s Mitigation Goals or Not Aligned with the Mitigation Goals

Climate finance and GHG emissions

The CEB’s technical staff consistently conducts climate change due diligence for all newly approved projects. The CEB’s investments focus on both climate change mitigation and adaptation efforts.

The Bank allocates a substantial part of our total financing volume to climate action each year (21% in 2024, up from 13% in 2021).

The GHG emission reductions achieved through CEB-financed projects are highlighting the Bank’s role in contributing to carbon emission reduction efforts.

This data is compiled and presented annually in the CEB’s TCFD report.

Environmental & Social Safeguards

The CEB’s Environmental and Social Safeguards Policy (ESSP) and Environmental and Social Safeguard Standards define the principles and requirements that projects and borrowers are expected to meet and outline the environmental and social due-diligence process that is applied to projects considered for CEB funding.

This is ensured by the Environmental and Social Sustainability – Climate Change Unit, who screens, assesses and monitors the social and environmental risks and impacts of all projects financed by the Bank throughout the project cycle, as well as the actions of the Bank’s clients to manage risks and address impacts. The CEB undertakes preliminary screening at the pre-appraisal stage of all project proposals submitted to the Bank, and categorises all operations approved throughout the year.

Climate risk management

In the risk management arena, the CEB developed in 2022 an approach and system to enhance the identification of physical climate risks at project/operation level.

At counterparty and portfolio levels, in 2023 the climate risk scoring of sovereigns was extended to include regional and local governments. Since 2024, there has been a systematic evaluation and climate-related scoring of all sovereign and local and regional government counterparties.

For more information, see the CEB’s TCFD Report.

The CEB’s own environmental footprint

Although most of the Bank’s environmental impact, both positive and negative, comes through its project financing activities, the CEB also supervises the environmental footprint resulting from the Bank’s internal operations including business travel, energy consumption or waste recycling at the Paris office. See the section on Internal Operations.

In this section

Related publications

-

Sustainability Report 2024

Sustainability pervades all aspects of the CEB’s work, and underpins its mission to promote social inclusion and leave … Published: May 2025 Read -

GRI Report 2024

This annual report provides stakeholders, including environmental, social and governance (ESG) rating agencies and socially responsible investors, with … Published: May 2025 Read -

Task Force on Climate-related Financial Disclosures (TCFD) Report 2024

The CEB has a key role to play in the global fight against climate change and promoting a … Published: July 2025 Read