Financing Activities

In an environment where social cohesion is under strain and the need for financing social investment is growing across Europe, the CEB is well placed to provide effective support, especially for the most vulnerable.

Sustainability-related objectives are embedded in lending, funding and treasury activities.

Project financing in 2024

In 2024, the CEB financed 44 new projects across 22 countries for a total amount of € 4.5 billion always with a focus on project with high social added value.

For detailed breakdowns by sector, both for project approved during the year and for projects in the portfolio, see the GRI Report.

The CEB also uses funds raised from donors to provide extra support to projects and enhance their social impact. Grants are used to make CEB’s high impact projects more sustainable, both financially and operationally. The extra support can take the form of technical assistance to help borrowers implement projects in line with best practices. It can also consist of investment grants or interest subsidies to reduce the financial burden for borrowers. Lastly, the Bank also uses donor funds to guarantee projects which would otherwise not be eligible for CEB loans due to their risk profile.

In 2024, the Bank approved €72 million in grants and guaranteed €46 million in loans.

Gender equality in CEB’s projects

Consolidating years of progress, in 2024 the CEB developed a new approach to gender equality to help achieve more impact in its financed operations, and better align with due diligence processes in relation to gender equality.

The approach will help ensure a systematic, harmonised and reliable gender analysis for all approved operations, and enable robust reporting on the CEB’s gender equality commitments.

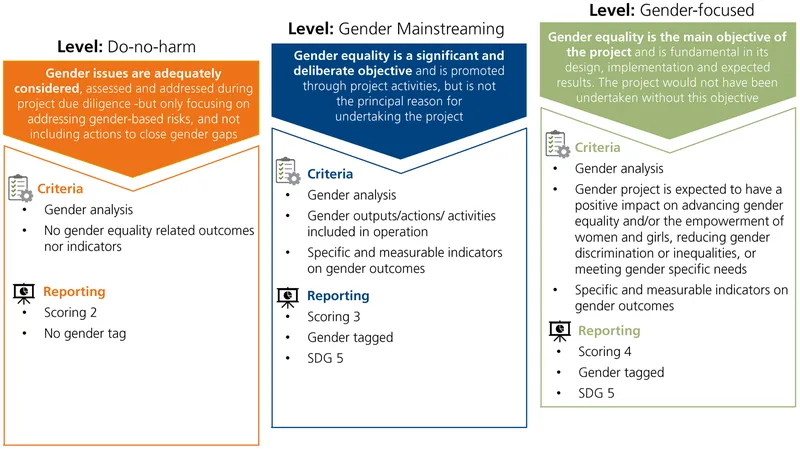

Based on the OECD markers, the CEB’s gender categorisation includes: “Do-no-harm” (mandatory for all operations), “Gender mainstreaming” (projects with significant gender-related activities) and “Gender-focused” (projects prioritising gender equality as the primary objective driving design and implementation) (Figure). Operations that “Risk doing harm” to gender equality cannot be financed by the CEB.

Figure: Three levels of gender categorisation for CEB loan financed projects

Sustainable procurement practices in CEB-financed projects

Following the adoption of new procurement guidelines in September 2023 by the Administrative Council, the Bank began mainstreaming sustainable procurement practices throughout its projects in 2024. Notably, the CEB partnered with the OECD to provide tailored advice for a project in Albania aimed at equipping schools nationwide with computers. Furthermore, the Bank collaborated with NALED, a non-governmental organisation in Serbia, to deliver training and capacity building programs to over 15 borrowers from Serbia, Montenegro and Bosnia & Herzegovina. These efforts are expected to lead to the systematic incorporation of sustainable procurement criteria in projects across these countries in the coming years.

The CEB’s Social Inclusion Bonds

In 2017, the CEB issued its inaugural Social Inclusion Bond, dedicated to financing social housing, education and micro, small and medium-sized enterprises (MSMEs). In 2020, for the money to be channelled to COVID-19 projects, the CEB’s Social Inclusion Bond Framework was amended to include health as the fourth eligible project sector. This Framework was further updated in 2022 to adopt a portfolio approach.

Social Inclusion Bonds are an essential tool for the CEB to be able to respond quickly and flexibly to member states’ most pressing social investment needs.

With more than €2.8 billion equivalent of Social Inclusion Bond issuance in 2024, the CEB is the largest multilateral development bank social bond issuer in the market.

The CEB’s bonds adhere to the following. International Capital Market Associations (ICMA) frameworks:

- the ICMA Social Bond Principles providing a set of requirements including reporting on the allocation of bond proceeds and their social impact;

- the ICMA Harmonized Framework for Impact Reporting for Social Bonds ensuring the presentation of bond data in a clear and precise format, including the SDGs addressed per project.

Opinions by external sustainability experts (i.e. Sustainalytics) are also provided on the social quality of these loans and their alignment to:

- the CEB’s sustainability objectives;

- the CEB’s Social Inclusion Bond Framework; and

- ICMA’s Social Bond Principles.

The allocation of proceeds to social loans is also reviewed by the Bank’s external auditors.

You can find all CEB Social Inclusion Bond Reports here, including detailed reporting on their social impact.

The CEB Treasury’s ESG investments

Another aspect of supporting the development of sustainable finance is to directly invest in ESG bonds. The CEB has been doing so since 2014. The Bank’s Treasury picks green, social and sustainability bonds to invest in and, for the decision-making process, follows the ICMA Principles (notably the Green Bonds Principles, which support issuers in financing environmentally sound and sustainable projects that foster a net-zero emissions economy and protect the environment). In addition to this, the CEB keeps a list of exclusion criteria. Besides, meetings are held with the issuers of these bonds, usually on an annual basis.

The share of the sustainable investments in the CEB’s medium and long-term investment portfolios has increased over the past years: therefore, the Bank’s ESG investments amounted to 22% (Green Bonds 11%) of its medium- and long-term investment portfolios at 31 December 2024, up from 20% at year-end 2023.

For more, see the TCFD Report.

In this section

Related publications

-

Sustainability Report 2024

Sustainability pervades all aspects of the CEB’s work, and underpins its mission to promote social inclusion and leave … Published: May 2025 Read -

GRI Report 2024

This annual report provides stakeholders, including environmental, social and governance (ESG) rating agencies and socially responsible investors, with … Published: May 2025 Read -

Task Force on Climate-related Financial Disclosures (TCFD) Report 2024

The CEB has a key role to play in the global fight against climate change and promoting a … Published: July 2025 Read