Press release

CEB posts robust interim financial results as at 30 June 2024 in a volatile environment

22 October 2024

Paris - The Council of Europe Development Bank (CEB) shows robust interim results in its Half-Year Financial Report, while delivering on the Bank’s Strategic Framework 2023-2027.

Today the CEB has released the Half-year Financial Report 2024 on its non-audited, condensed interim financial statements. The report is issued in compliance with international accounting standard IAS 34 Interim Financial Reporting.

In the first half of 2024, the financial situation of the CEB remained robust in a volatile environment, characterised by overlapping crises and urgent social needs. In this context, the Bank’s operations continue to align with the overarching goals of the CEB Strategic Framework, bolstered by the capital increase, which became effective on 29 February 2024.

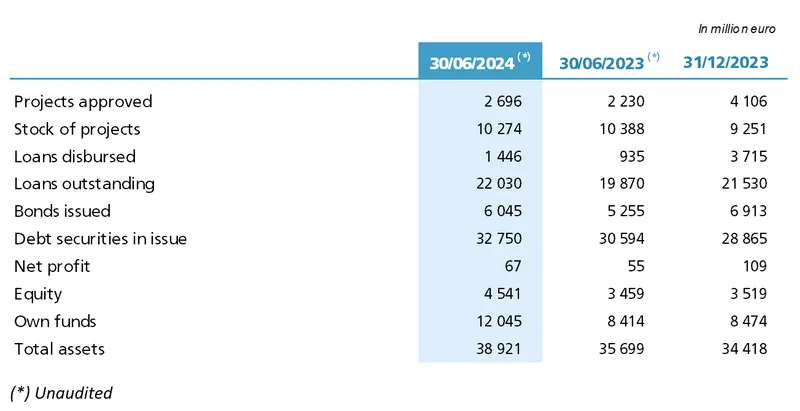

The CEB’s net profit for the first half of 2024 rose by 22.9% to reach €67.1 million, compared to €54.6 million for the first half of 2023. Core earnings showed a positive trend to reach €63.4 million as at 30 June 2024, a 16.9% increase compared to 30 June 2023, reflecting an increase of €11.5 million in the Bank’s interest margin, resulting from higher income from securities at amortised cost, and active management of liquidity and interest rate positions. The two elements outside core earnings – financial instruments valuations and cost of risk – presented positive developments in the first half of 2024, compared to a volatile but offsetting development in the first half of 2023.

The CEB’s total balance sheet reached €38.9 billion at the end of June 2024, representing an increase of 13.1% compared to 31 December 2023 (€34.4 billion), driven by the normal cyclical activity in financing in the course of the year.

Loans at fair value in the balance sheet stood at €21.0 billion, an increase by 1.9% compared to €20.6 as at 31 December 2023. Outstanding loans in nominal terms stood at €22.0 billion, up by 2.3% compared to year-end 2023 and by 10.9% compared to June 2023, reflecting the sustained activity observed over the one-year period.

Meanwhile, equity reached €4.5 billion as at 30 June 2024, an increase of 29% compared to year-end 2023 (€3.5 billion), mainly due to positive impact related to the called capital from the CEB’s capital increase, net profit from the first half of 2024 and negative impact related to 2023’s net profit allocation to the Bank’s Social Dividend Account and to the Ukraine Solidarity Fund, as well as to the variation of gains or losses recognised directly in equity.

In terms of risk, the CEB maintained its prudent approach and its risk appetite ratios remained within the approved limits throughout the reporting period. As in previous years, the Bank did not record any default or late payments from counterparties as at 30 June 2024.

For the first half of 2024, new projects amounting to €2.7 billion have been approved and loans disbursed stood at €1.4 billion. The stock of projects approved and awaiting financing reached €10.3 billion as at 30 June 2024, compared to €9.3 billion as at 31 December 2023.

In April 2024, the CEB issued its largest syndicated Social Inclusion Bond (SIB) to date, valued at €1.25 billion over a seven-year term, followed by a US$1 billion three-year Global SIB Benchmark in June. Since the inaugural SIB in 2017, the CEB has now reached the €10 billion milestone in issuance.

Key half-year figures 2024

Click here for CEB Financial Report 2023 and the Bank’s previous annual and half-year financial reports.

The Council of Europe Development Bank (CEB) is a multilateral development bank, whose mission is to promote social cohesion in its 43 member states across Europe. The CEB finances investment in social sectors, including education, health and affordable housing, with a focus on the needs of vulnerable people. Borrowers include governments, local and regional authorities, public and private banks, non-profit organisations and others. As a multilateral bank with an excellent credit rating, the CEB funds itself on the international capital markets. It approves projects according to strict social, environmental and governance criteria, and provides technical assistance. In addition, the CEB receives funds from donors to complement its activities.