Overview

“Sustainability pervades all aspects of the CEB’s work, and underpins its mission to promote social inclusion and leave no one behind.” - Governor Carlo Monticelli

The CEB and Sustainability

The 2023-2027 Strategic Framework enables the CEB to assist its member states in meeting their social investment needs and effectively responding to escalating crises, with a view to strengthening Europe’s social fabric and prioritising support for vulnerable people.

The CEB aims to develop a cross-cutting approach to sustainability that rests on complying with ESG (environment, social and governance) criteria at corporate level; ensuring environmental and social safeguards at project level; addressing climate change with a people-centred focus; and contributing to the 2030 Agenda for Sustainable Development.

Managing Sustainability

Sustainability is embedded in all the CEB’s activities, from its core business to its internal operations, encompassing both the CEB’s own means and resources and its financing activities to promote social cohesion and serve vulnerable people. The CEB helps to lead the global effort towards a just and socially inclusive climate transition in its 43 member states.

At a strategic level, the CEB’s Strategic Framework 2023-2027, approved by the Governing Board, sets the mid-term vision for the Bank’s operations and is intrinsically linked to social and environmental sustainability. The Paris alignment framework, and accompanying roadmap, defines the Bank’s climate approach.

At the operational level, the CEB is strongly committed to fostering social and environmental sustainability both in its project financing (see the Environmental and Social Safeguards Policy) and in its internal operations (see the CEB Environmental Statement). The Public Information Policy describes the way the CEB discloses information by seeking to facilitate the widest possible access.

More specifically, sustainability topics that concern the CEB as a whole, e.g. reporting and disclosure, ESG ratings, stakeholder engagement, and coordination between directorates through an internal network of ESG correspondents, are dealt with by the Corporate Responsibility & ESG Reporting Unit.

The Environmental and Social Sustainability – Climate Change Unit ensures consistent implementation of the Bank’s Environmental and Social Safeguards policy.

Climate-related initiatives, including the Paris Alignment Framework and Roadmap, are implemented by a dedicated Steering Committee and Working Group.

Being accountable and transparent

The CEB commits to be transparent and accountable, and to conduct its business according to the highest standards of integrity and compliance.

In particular, the Office of the Chief Compliance Officer (OCCO) ensures that the prevention of money laundering, terrorist financing, harmful tax practices and the CEB’s commitment to high standards of integrity, ethics, anti-fraud and anti-corruption, are integrated into all phases of the Bank’s project cycle. Information security is a significant part of OCCO’s mandate, and is managed by the Chief Information Security Officer (CISO).

The CEB’s revamped Integrity and Compliance Policy, approved by the Administrative Council in January 2024, modernises the Bank’s compliance-related governance framework, aligning with international best practices and peers.

If you wish to raise an issue with OCCO, use: compliance@coebank.org or whistleblowing@coebank.org.

The Office of the Chief Compliance Officer also publishes an annual Integrity and Compliance Report.

Transparency and accountability are also ensured by regular public reporting and disclosure. Since 2009, the CEB has provided an annual account of its approach to sustainability. The Bank's overall contribution to socially and environmentally sustainable development is therefore reflected in the annual Sustainability Report and companion Global Reporting Initiative (GRI) Content Index, as well as in a Task Force on Climate-related Financial Disclosures (TCFD) Report.

In addition, there is dedicated reporting on the CEB’s Social Inclusion Bonds (including the Bonds’ link to the Sustainable Development Goals), and disclosure on lessons learnt from the Bank’s project monitoring and evaluation activities.

Stakeholder Engagement through a materiality assessment

The starting point for defining the Bank’s material sustainability topics is to assess the related risk and opportunities: how the CEB could be affected by sustainability issues, including from a financial perspective – and impacts: how the Bank impacts society, the environment and ultimately people’s lives, both constituting the CEB’s approach to ‘double materiality’.

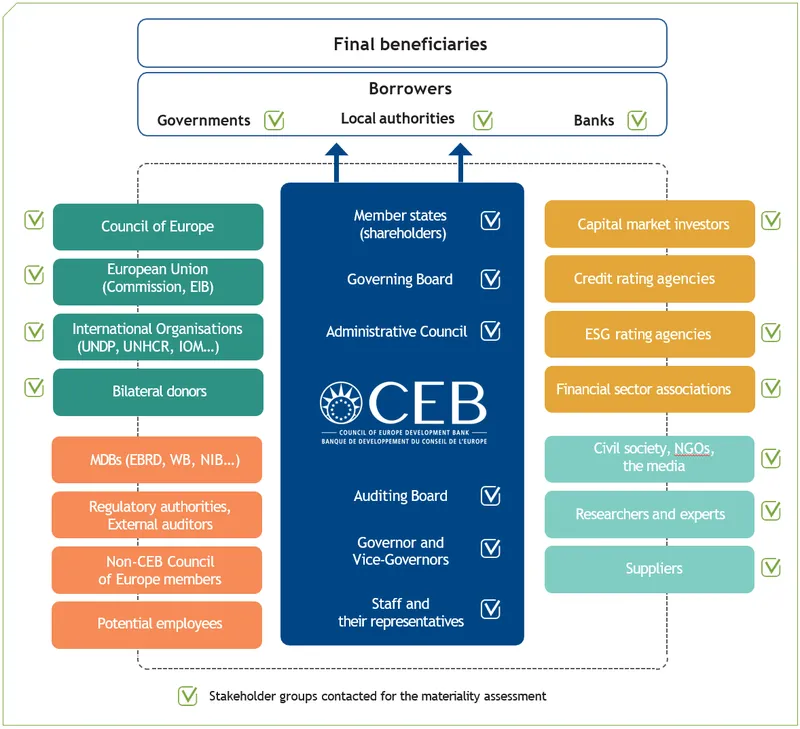

In 2024, the CEB performed a pilot to update its materiality assessment with dedicated stakeholder engagement that is linked to this exercise. The stakeholder groups contacted for preparing this pilot were:

Engagement through partnerships

Some examples of our engagement in 2024 were:

The CEB is a regular participant in the United Nations Climate Change Conferences (COP), such as COP 29 in Baku in November 2024.

In 2024, the CEB took part in the fifth edition of the Finance in Common Summit (FiCS). The Bank co-leads the FiCS Coalition for Social Investment, which it launched in 2020 jointly with the Agence Française de Développement, and joined the FiCS Coalition on Resilient Cities and Regions in 2022.

For the fifth year in a row, the CEB ran its Award for Social Cohesion, to recognise organisations and projects that help to address pressing social issues and drive social cohesion in CEB member states.

For more on partnerships see also here.

In this section

Related publications

-

Sustainability Report 2024

Sustainability pervades all aspects of the CEB’s work, and underpins its mission to promote social inclusion and leave … Published: May 2025 Read -

GRI Report 2024

This annual report provides stakeholders, including environmental, social and governance (ESG) rating agencies and socially responsible investors, with … Published: May 2025 Read -

Task Force on Climate-related Financial Disclosures (TCFD) Report 2024

The CEB has a key role to play in the global fight against climate change and promoting a … Published: July 2025 Read